Major averages fall, break three-day win streaks to start August

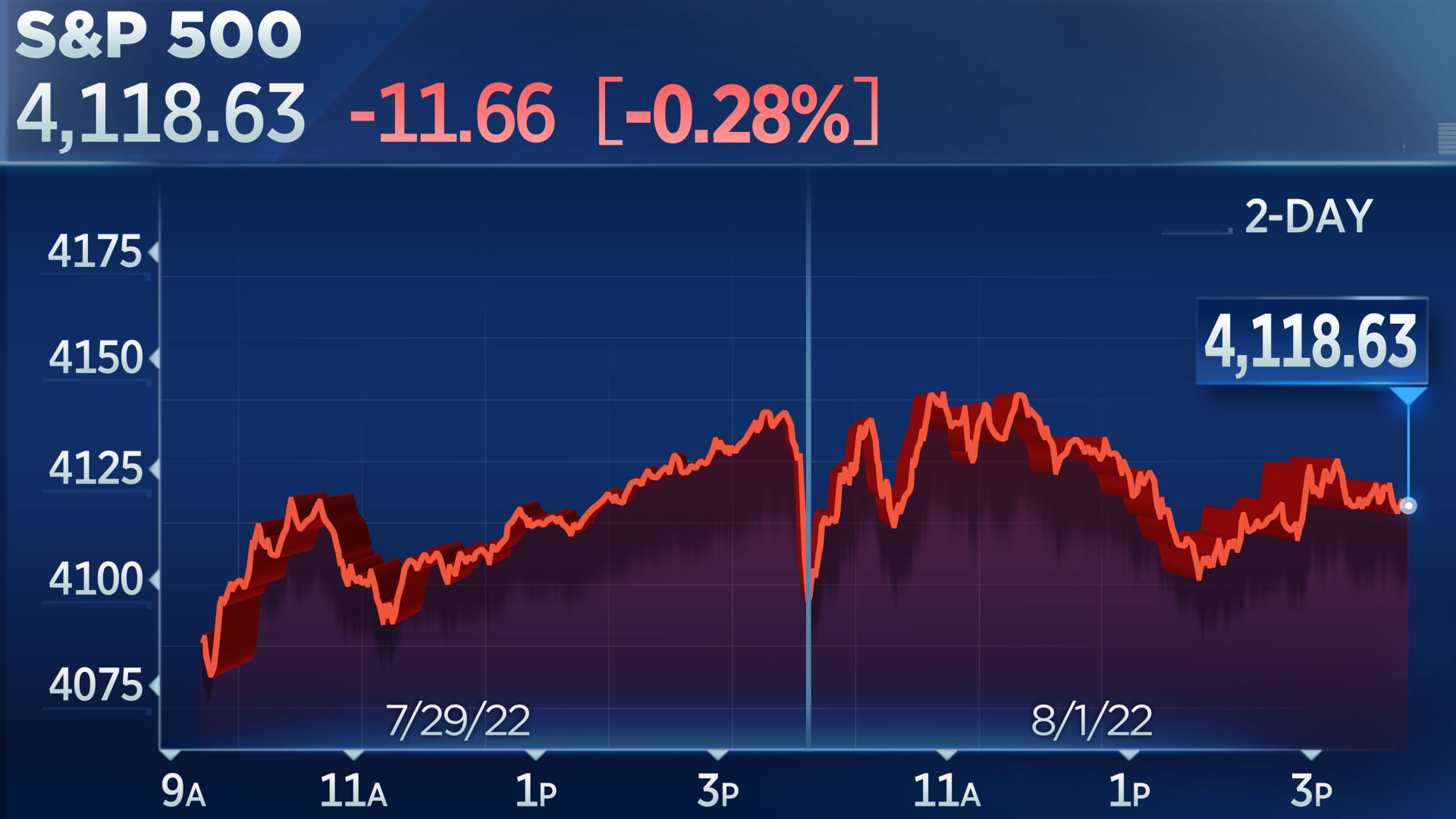

The S&P 500, Dow Jones Industrial Average and the Nasdaq Composite all closed Monday’s trading session in the red, snapping three-day win streaks for each. It was the first day of trading in August following a solid performance in July, which was stock’s best month since 2020.

The S&P 500 shed 0.28% to end at 4,118.63. The Nasdaq Composite lost 0.18% and closed at 12,368.98. The Dow Jones Industrial Average shed 46.73 points, or 0.14%, to end at 32,798.40.

— Carmen Reinicke

1 Hour Ago

10-year Treasury continues to break lower on worries about economy

The closely watched 10-year Treasury yield continued to slide Monday, as traders worried about economic weakness.

The 10-year yield, which moves opposite price, was at 2.61% in afternoon trading, after earlier falling below 2.60%. It was as high as 2.69% earlier in the session. Traders said the break below 2.70% was significant.

Loading chart…

“There’s growing apprehension about the overall trajectory of the U.S. economy,” said Ian Lyngen, head of U.S. rates strategy at BMO. “If we break 2.55%, then 2.50% becomes an attractive level.”

He said the market is also pricing out some inflation expectations. “Energy prices are off today and that’s helping.”

The 10-year yield is key since it impacts mortgage rates and other consumer and business loans.

—Patti Domm

1 Hour Ago

Stocks slip in last hour of trading

Stocks fell slightly into negative territory heading into the last hour of trading on Monday. The S&P 500 slipped 0.19% and the Nasdaq Composite lost 0.001%. The Dow Jones Industrial Average was down 7 points, or about 0.03%.

— Carmen Reinicke

1 Hour Ago

July S&P 500 gains were a bear market rally, BofA’s Subramanian says

July’s S&P 500 gains marked the second bear market rally of more than 10% this year, Savita Subramanian, BofA Securities head of U.S. equity and quantitative strategy, wrote in a Monday note to clients.

“We view this as a bear market rally, which is common, occurring 1.5 times on avg. per bear market since 1929,” Subramanian said. Aug. and Sept. are traditionally weak months for stocks, the strategist added and maintained the firm’s 3600 price target for the S&P 500.

This July was also the month’s best performance since the Great Depression, according to the note.

— Carmen Reinicke

1 Hour Ago

Energy stocks are falling and could be in for tough month – chart analyst

Oil and gas stocks fell hard as oil slumped nearly 5%.

Mark Newton, Fundstrat global head of technical strategy, expects oil could to continue to decline to the $85 per barrel range. West Texas Intermediate crude futures were just under $94 per barrel in afternoon trading.

Loading chart…

“Most of energy can get smushed in the short run,” he said. “I am a longer term energy bull.”

But in the near term, oil is making a technical break, he said. “Energy is not going to be the place to hide in August.”

The Energy Select Sector SPDR Fund ETF, which represents the S&P energy industry, was down 2.4% in afternoon trading. Exxon Mobil was down more than 2.5%, and Chevron was off just about 2%.

—Patti Domm

1 Hour Ago

Devon announces earnings, trading halted

Shares of Devon Energy were halted as the company released its second-quarter earnings report on Monday afternoon. The stock was last down 1.7% for the session.

Devon said it earned an adjusted $2.59 in earnings per share and generated $2.1 billion in free cash flow, which was the largest in the firm’s history. The company also declared a dividend of $1.55 per share and announced that it was raising production targets for the full year by 3%.

Devon had previously said it would release its second-quarter results today after the market close.

The company said it will hold a conference call to discuss the quarter on Tuesday morning.

—Jesse Pound

2 Hours Ago

Santoli: S&P 500 clears big hurdle, but another challenging level awaits

Check out some of CNBC senior market commentator’s Michael Santoli’s notes on Monday’s session:

- The market rushed up to a crucial level in the past week and month. It is pausing there to survey the scene.

- The worst first half in a half-century is followed by a +9% month in S&P 500, allowing resolute bears to dismiss the action as a mere squeezy oversold bear-market bounce while sending a few signals to optimists that the push higher was broad enough to have positive implications for the next 6 to 12 months’ equity returns.

- The first hurdle was cleared: a decisive break of the April-July downtrend and the 50-day average, placing the S&P 500 right at its 100-day average and the top of a roughly three-month range. Plenty of obvious resistance sits above (4,230 is the halfway point of the entire decline from the January peak) but the market has done enough to suggest mid June was a plausible important low.

CNBC Pro subscribers can get his full notes here.

3 Hours Ago

Second-half outlook for stocks looking more attractive, JPMorgan’s Kolanovic says

One of the most widely followed strategists on Wall Street is growing more optimistic on stocks going forward.

“Although the near term activity outlook remains challenging, we believe that the risk-reward for equities is looking more attractive as we move through 2H,” wrote JPMorgan’s Marko Kolanovic. He noted that, despite last week’s disappointing GDP report, some encouraging signs have started to emerge, “as firms sharply slowed their pace of stockbuilding, and real consumption eked out a gain in June as households continue to cushion inflation shocks with a lower saving rate.”

Kolanovic has been remained largely optimistic on stock throughout 2022. In June, he said he expected the S&P 500 to finish the year flat. As of Monday afternoon, the benchmark index is down more than 13%.

—Fred Imbert

3 Hours Ago

GE on track for longest win streak in 50 years

Shares of General Electric gained nearly 1% during Monday’s session, putting the stock on track for its 12th-straight day of gains. If it closes in the green, it will be the company’s longest win streak in 50 years.

Loading chart…

— Carmen Reinicke

3 Hours Ago

Early outlook for Q3 economic growth doesn’t look good

The outlook for economic growth in the third quarter already is looking fairly grim.

Following Monday’s ISM manufacturing reading, which was the lowest since June 2020, tracking data for Q3 growth moved lower.

The Atlanta Federal Reserve’s GDPNow real-time tracker now is indicating a gain of just 1.3%, down from the initial 2.1% reading Friday. Goldman Sachs also lowered its outlook, dropping its already meager 1% tracking estimate down to 0.9%. Also, Capital Economics said the early Q3 data is pointing to an annualized GDP gain of just 1.5%.

That follows Thursday’s advance estimate of Q2 which showed a decline of 0.9%. Following Q1’s 1.6% decline, that put the economy into a widely accepted definition of recession.

— Jeff Cox

3 Hours Ago

Boeing leads stocks making the biggest moves midday

Shares of Boeing continue to surge Monday, leading the Dow Jones Industrial Average higher. The stock jumped after CNBC reported that the Federal Aviation Administration has approved inspection protocol revisions that should allow the jet maker to resume deliveries of its 787 Dreamliner. The company also avoided a strike at some of its manufacturing plants.

4 Hours Ago

Stocks at midday: S&P 500 slips, Dow, Nasdaq up

Stocks were mixed in midday trading, continuing the earlier trend of struggling to find a solid direction. The S&P 500 erased earlier gains to slip about 0.2%. The Dow was up about 53 points or 0.16% and the Nasdaq was up 0.33%

— Carmen Reinicke

5 Hours Ago

Oil heading back to $130, says Goldman

Oil prices declined on Monday amid demand concerns, but Goldman’s Jeff Currie believes fears of an all-out demand slowdown are overblown.

He sees international benchmark Brent crude touching $130 by the end of the year. On Monday, the contract traded roughly 3.2% lower at $100.68 per barrel.

Supporting his bull case is the demand picture. While demand growth might be slowing, it’s not contracting. Currie said this key point is being left out of the broader narrative in the commodities market.

“The overall demand picture — it’s still growing,” he said Monday on CNBC’s “Squawk Box.”

— Pippa Stevens

5 Hours Ago

Enjoy this rally while it lasts, says Mike Wilson

Traders work on the floor of the New York Stock Exchange (NYSE) on December 02, 2021 in New York City.

Spencer Platt | Getty Images

Morgan Stanley’s chief U.S. equity strategist Michael Wilson believes the recent rally won’t last long as corporate earnings are posited to start deteriorating.

“While the bond market is starting to assume they get inflation under control, it may come with a heavier cost than normal, potentially a recession while they are still tightening, which may leave a very small window for stocks to work before earnings surprise on the downside,” Wilson said in a note to clients.

“We think that window is now but it can shut quickly. Risk reward is poor after the recent rally so trade accordingly as time may be running out,” he added.

Wilson, one of Wall Street’s biggest bears, said the decline in stocks in June didn’t fully reflect the risk of a recession as earnings typically fall much more drastically in a downturn.

— Yun Li

5 Hours Ago

Stocks are struggling for direction

The market can’t seem to pick a trend in early trading.

The major averages wavered between gains and losses for most of the month’s first hour of trading. The Dow Jones Industrial Average, for example, fell as much as 204 points — only to trade as much as 87 points higher minutes later. As of 10:42 a.m. ET, the 30-stock average was down just 8 points.

Loading chart…

This choppy trading action comes amid somewhat weak market breadth. Roughly four stocks declined at the New York Stock Exchange for every three advancers. Meanwhile, just 193 S&P 500 stocks were positive on the day.

To be sure, these moves come amid relatively high volume, at least in early trading. FactSet data shows the SPDR S&P 500 ETF Trust (SPY), which tracks the benchmark index, traded 9.17 million shares between 9:30 a.m. and 9:59 a.m. ET. That’s well above an average of 7.29 million shares traded in that time period. The SPY has also topped its average volume for the 10 a.m.-10:59 a.m. time frame, with 19.36 million shares having exchanged hands.

—Fred Imbert

6 Hours Ago

Manufacturing index hits lowest since June 2020 as price increases slow

A worker builds frames for solar panels at First Solar in Perrysburg, Ohio July 8, 2022.

Megan Jelinger | Reuters

Manufacturing expanded in July for the 26th straight month, but at the slowest pace since June 2020, according to the latest Institute for Supply Management reading.

The index registered a 52.8 reading for the month, representing the percentage of businesses seeing growth for the month. The number fell slightly from June’s 53 reading, but was a bit above the Dow Jones estimate for 52.1.

Importantly, one big reason for the low reading was a massive slide in the prices index, which tumbled 18.5 points to 60. Though the number indicates that price increases are still strong, the relative decline is significant for an economy with an inflation rate running at its fastest pace since the early 1980s. The monthly decline in the index was the biggest fall since June 2010.

In another encouraging development, the employment index rose to 49.9, still barely in contraction territory but 2.6 points higher than June. New orders dropped to 48 while inventories edged higher to 57.3.

Comments from participants indicate that inflation and supply chain bottlenecks remain a concern.

“Growing inflation is pushing a stronger narrative around pending recession concerns. Many customers appear to be pulling back on orders in an effort to reduce inventories,” said one respondent in the food, beverage and tobacco products industry.

— Jeff Cox

6 Hours Ago

Oil leads the sell-off, Cramer says

Declining oil prices are the main contributor to the early sell-off hitting markets, according to Jim Cramer.

“This sell-off by the way is all oil, which is really rather amazing,” he said on CNBC’s “Squawk on the Street” on Monday.

Oil prices slipped on the back of weak manufacturing data from China and Japan and ahead of a meeting of OPEC officials. Brent crude at one point dipped below $100 a barrel.

— Samantha Subin

6 Hours Ago

Consumer sectors buck market’s negative trend

Both the consumer staples and consumer discretionary sectors traded higher Monday, bucking a broader market decline. The S&P 500 staples sector advanced nearly 1%, while consumer discretionary gained 0.8%. Colgate-Palmolive led staples with a 2.6% gain. Dollar Tree, Dollar General and Target advanced more than 2% each to lead discretionary stocks higher. Tesla, which is also part of the discretionary sector, gained 4.2%.

—Fred Imbert

7 Hours Ago

Energy stocks fall as oil slumps

The weakness in oil prices was weighing on major energy stocks in early trading.

Shares of Diamondback Energy fell 3.7%, while ExxonMobil slid more than 2%. Chevron dipped 1.6%. Devon Energy and Occidental Petroleum shed 2.6% and 1.5%, respectively.

Futures for U.S. benchmark West Texas intermediate crude were last down more than 5%, trading at roughly $93.30 per barrel. European benchmark Brent crude fell more than 4% to break below $100 per barrel.

Loading chart…

— Jesse Pound

7 Hours Ago

Stocks fall to kick off Monday

Stocks fell to start Monday’s session, kicking off August in the red. The Dow Jones Industrial Average slipped 154.4, points, or 0.47%. The S&P 500 fell 0.81% and the Nasdaq Composite dropped 0.90%.

— Carmen Reinicke

7 Hours Ago

Tech shares set to lead the market lower

Technology shares, among the best performers since the market bottomed in mid-June, were set to fall slightly on Monday. Apple, Microsoft, Alphabet were all in the red in premarket trading. Apple shares are up 25% since the S&P 500’s bottom on June 16 through Friday. Microsoft is up 14% and Alphabet is 10% higher over the same period.

— John Melloy

8 Hours Ago

Here are the reasons why the bottom is not in yet, according to BofA’s Subramanian

It’s too soon to call the bottom even as the S&P 500 just enjoyed its best month since November 2020, according to BofA Securities head of U.S. equity and quantitative strategy Savita Subramanian.

The strategist said the stock market typically bottoms after earnings estimates get slashed dramatically, but that hasn’t happened yet.

“Was June low the big low? We need more EPS cuts,” Subramanian said in a note. “We are still in the very early innings of downturn and estimate cuts.”

During the prior five recessions except in 1990, the S&P 500 bottomed after estimates were revised down, but today, estimate cuts are just starting and forward earnings per share is still up 7% since the market peak, the strategist said.

Secondly, Bank of America’s bull market signposts indicate it’s premature to call a bottom. Subramanian said historical market bottoms were accompanied by over 80% of these indicators being triggered, and now just 30% are triggered.

Lastly, she said bear markets always ended after the Federal Reserve started to cut interest rates, which is a scenario that’s at least six months away.

— Yun Li

8 Hours Ago

Boeing rises in premarket trading

A Boeing 787-10 Dreamliner taxis past the Final Assembly Building at Boeing South Carolina in North Charleston, South Carolina, March 31, 2017.

Randall Hill | Reuters

Shares of Boeing rose more than 4% in premarket trading, helping to trim the overnight losses for futures.

The move comes after the Wall Street Journal and Reuters reported over the weekend that U.S. regulators approved the company’s planned inspection changes to the 787 Dreamliner.

Additionally, a potential strike among Boeing machinists in St. Louis was averted until at least Wednesday, when the workers will vote on a new contract.

Boeing’s stock has been hot in recent weeks, rising more than 16% in July.

— Jesse Pound

8 Hours Ago

Stock futures slump

Stock futures fell back into the red on Monday ahead of market open, erasing earlier gains. Dow Jones Industrial Average futures shed 49 points, or 0.15%. S&P 500 futures and Nasdaq 100 futures slipped 0.27% and 0.17%, respectively.

— Carmen Reinicke

8 Hours Ago

Oil prices move lower on demand concerns

Oil prices declined during Monday morning trading on Wall Street after soft manufacturing data out of China prompted demand slowdown concerns.

West Texas Intermediate crude, the U.S. oil benchmark, shed 2.3%, or $2.31, to trade at $96.31 per barrel. International benchmark Brent crude dipped 1.8% to $102.07 per barrel.

WTI rose 4.14% last week, for its first positive week in four. However, it ended July in the red for its second straight losing month.

— Pippa Stevens

8 Hours Ago

Stock futures climb back from overnight lows

Stock futures rose from overnight lows to trade flat Monday morning ahead of the open. Both Dow Jones Industrial Average futures and Nasdaq 100 futures turned positive, trading slightly in the green. S&P 500 futures were still negative but gained from trading overnight.

— Carmen Reinicke

9 Hours Ago

U.S. Dollar lowest since July 5

U.S. dollar bills seen on display. The euro nursed losses on Wednesday after its sharpest drop in two weeks, as a cut in Russian gas supply sent energy prices soaring, while the dollar held ground ahead of an expected U.S. interest rate hike later in the day.

Igor Golovniov | Lightrocket | Getty Images

The dollar index sank to 105.311 Monday, its lowest level since July 5 as investors bet that the Federal Reserve’s rate hikes will tip the economy into recession. Year to date, the index is still up nearly 10%.

- The dollar slumped to 131.87 against the yen, its lowest in six weeks.

- Both the Euro and the Pound gained against the dollar as well, hitting the highest levels against the currency since July 21 and June 28, respectively.

- The Australian dollar also rose to 0.7046 against the dollar.

— Carmen Reinicke

9 Hours Ago

Bitcoin edges lower after posting its best month of the year

Bitcoin fell about 3% early Monday after coming off its best month of 2022, as stock futures took a small dip. The cryptocurrency rallied on Wednesday through Friday as investors responded to updates from the Federal Reserve about its rate hiking path as well as the latest GDP report, and pulled back over the weekend as the possibility that the market has likely hit a bottom began to settle in. Bitcoin continues to trade in tandem with stocks, whose major indexes also notched their best months of the year Friday.

“Bitcoin may be struggling to break above the $24,000 level, but its weekly candle finally closed above the 200-week moving average and that could improve the technical sentiment significantly,” said Yuya Hasegawa, crypto market analyst at Japanese crypto exchange Bitbank. “In case of break out, the price could retrace its June loss and could go as high as $32,000.”

— Tanaya Macheel

10 Hours Ago

Target shares rise on upgrade

A Target store in New York, on Thursday, July 28, 2022.

Victor J. Blue | Bloomberg | Getty Images

Target shares jumped about 2.5% in early trading after Wells Fargo upgraded the stock to overweight from equal weight, saying the recent pullback was a good buying opportunity. Target shares are down 29% so far this year amid inflation curbing consumer spending and lingering supply chain issues.

— John Melloy

10 Hours Ago

Strong July sets up S&P 500 for more gains in August and September, Bank of America says

The Charging Bull or Wall Street Bull is pictured in the Manhattan borough of New New York, January 16, 2019.

Carlo Allegri | Reuters

The market’s strong performance in July could be lead to more gains in August and September, data compiled by Bank of America shows.

Stephen Suttmeier, a technical strategist at the bank, said in a note that, when the S&P 500 rises 5% or more in July, “August and September show stronger seasonality vs when July is not up 5% or more and for all years back to 1928.”

More specifically, the benchmark index averages a return of 2.01% in August after such a strong July, with the S&P 500 rising 59% of the time. September, meanwhile, is up 55% of the time and averages a return of 0.73% in these scenarios.

The S&P 500 rallied 9.1% in July, marking its biggest one-month gain since November 2020.

— Fred Imbert

11 Hours Ago

European markets make a cautious start to August trading; HSBC up 6%

— Elliot Smith

13 Hours Ago

Alibaba says it will try to keep U.S., Hong Kong listings

Signage for Alibaba Group Holding Ltd. covers the front facade of the New York Stock Exchange November 11, 2015.

Brendan McDermid | Reuters

Chinese e-commerce giant Alibaba said it will comply with U.S. regulators and work to maintain its listings in New York and Hong Kong.

“Alibaba will continue to monitor market developments, comply with applicable laws and regulations and strive to maintain its listing status on both the NYSE and the Hong Kong Stock Exchange,” it said in a statement to the Hong Kong bourse.

The statement came after Alibaba was added to the U.S. Securities and Exchange Commission’s list of Chinese companies at risk of being delisted for not meeting auditing requirements on Friday. U.S.-listed Alibaba shares plunged 11% in the Friday trading session.

— Sumathi Bala

16 Hours Ago

Wall Street analysts back these ‘safe-haven’ consumer stocks to outperform — even if spending slows

Inflation is hitting consumers’ wallets, and the economy looks to be slowing.

With the consumer accounting for 68% of all economic activity in the first quarter, it is a key metric to watch.

What does all of this mean for consumer-related companies, and will they hold up in a recession? Wall Street analysts pick the consumer stocks they say are resilient, even as the economy slows. Pro subscribers can read more here.

— Weizhen Tan

18 Hours Ago

Growth in Chinese factory activity slowed in July, private survey shows

Chinese factory activity grew in July, but at a slower pace than in June, according to the latest Caixin/Markit manufacturing Purchasing Managers’ Index.

The private survey print came in at 50.4, down from 51.7 in June.

PMI readings are sequential and represent expansion or contraction from the month before. A figure above 50 represents growth.

Over the weekend, official data from the National Bureau of Statistics showed that factory activity declined, with the PMI at 49.

— Abigail Ng

22 Hours Ago

Earnings season numbers

So far, 56% of companies in the S&P 500 have reported results for the second quarter 2022. Of those, 73% have reported EPS results above analyst estimates, according to FactSet.

That means that so far, blended earnings growth – including both companies that have reported and estimates for those reporting later – is 6% for the second quarter. That’s higher than the blended earnings growth seen in last week.

Still, if the actual earnings growth rate is 6% at the end of the season, it will mark the lowest earnings growth rate for S&P 500 companies since the fourth quarter of 2022.

Revenue, on the other hand, is outperforming earnings. The blended revenue growth rate so far is 12.3%, up from last week and last quarter. If the actual revenue growth rate is 12.3% it will mark the sixth-straight quarter of year-over-year revenue growth of more than 10% for the index.

— Carmen Reinicke

22 Hours Ago

Stats for the end of July

All three major indexes ended the day higher on Friday, capping off a solid month of trading in July. Here are other key stats about how stocks traded last month.

- The Nasdaq composite closed more than 22% from 52-week highs, while the S&P 500 and the Dow closed more than 14% and 11% from their 52-week highs, respectively.

- The Dow gained 6.73% in July, its best month since Nov. 2020. It was also the S&P 500’s best month since Nov. 2020. It gained 9.11% in July.

- The Nasdaq composite gained 12.35% in July and broke a three-month losing streak. It was the best month for the index since April 2020.

- Only health care, consumer staples and utilities sectors closed within 10% of 52-week highs. Still, all 11 sectors were positive in the month of July.

- U.S. Treasury yields were lower on Friday, narrowing spreads.

— Carmen Reinicke

22 Hours Ago

Last week in the stock market

Investors are still watching for signs that the U.S. is in a recession and that inflation is slowing down. Last week, the Federal Reserve increased its benchmark interest rate by another three-quarters of a percentage point to stave off high inflation.

The first reading of second-quarter GDP on Thursday was negative, potentially pointing to a technical recession. On Friday, the June personal consumption expenditures hit the highest level since January 1982. The report is a key inflation measure.

Solid earnings reports from Amazon and Apple boosted each company stock and lifted the indexes higher to round out July. Energy companies such as Chevron and Exxon Mobil also rose on better-than-expected reports, ending Friday higher. Not all earnings have been rosy, however. Meta Platforms and Intel both posted disappointing results, sending shares lower.

— Carmen Reinicke

22 Hours Ago

Stock futures open lower

Stock futures opened just slightly lower to start trading Sunday evening.

Dow and S&P 500 futures were lower by 0.2%. Nasdaq futures were off by about 0.3%.

— John Melloy

22 Hours Ago

What’s ahead this week

Stocks enter the typically volatile month of August with a tailwind. There are dozens of earnings reports in the week ahead, with more than 20% of the S&P 500 companies reporting. There is also key data, with Friday’s July jobs report the most important.

Big economic reports could become important catalysts now that the Federal Reserve has indicated it is going to rely on data for its decision on how much to raise interest rates in September. Fed Chairman Jerome Powell said the labor market remains strong, and investors worried about an economic slowdown will be carefully watching to see how strong job creation remains. There are 250,000 jobs expected. According to CFRA, since 1995, the S&P 500 has averaged a 0.5% decline in August. Strategists say earnings could remain a positive force.

“A lot of this is better than feared. If that process continues, it’s likely to help the market grind higher. The market seems to be sitting on this notion that we had priced in Armageddon and thus far, that has not been thrust upon us,” said one strategist.

— Patti Domm

from Wall Street Exchange – My Blog https://ift.tt/v7bJXgB

via IFTTT

No comments:

Post a Comment