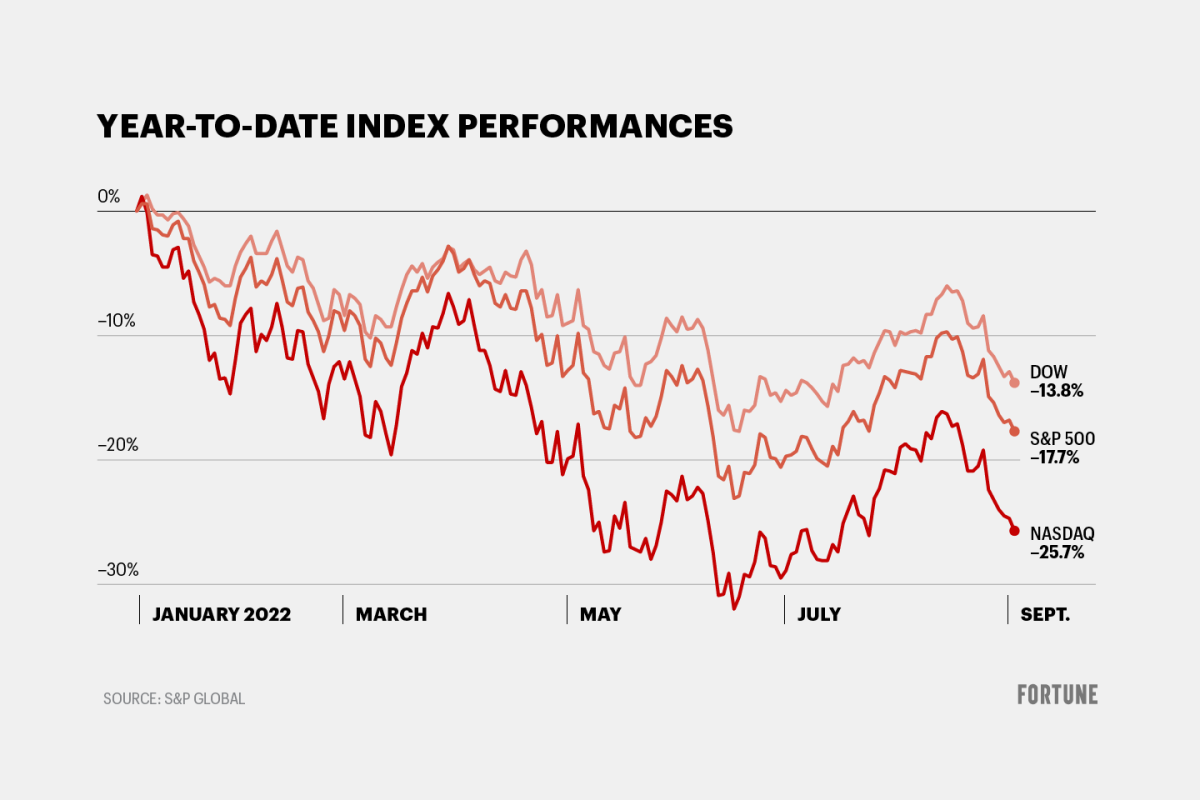

The S&P 500’s decline this year—it’s down nearly 18% since January—accelerated last week after Federal Reserve Chair Jerome Powell indicated more “pain” was ahead.

Has the market hit bottom? Bank of America Research, based on its new list of 10 signals showing whether the stock market has hit bottom, says no.

View this interactive chart on Fortune.com

The bank came up with the list, released on Friday, after analyzing “macro and bottom-up data encompassing policy, valuation, growth, sentiment and technical trends,” the researchers said.

As of Friday, only four of the 10 criteria have been met. That means there are six more that must be hit before it’s really a market bottom, at least according to Bank of America’s formula.

The four indicators that are considered triggered include the unemployment rate rising. The latest monthly jobs report, released Friday, showed that the unemployment rate rose to 3.7% in August from 3.5% the month prior, a relatively good sign in terms of reducing inflation because it hints that the economy is slowing.

Additional positive indicators for a market bottom included the bear-to-bull ratio of major investors whose sentiments lean toward a more bearish outlook. The others were multiple bear market rallies of 5% or more (the bank says there have been two rallies of 5% or more so far), and the Purchasing Managers’ Index—a measure of the prevailing direction of economic trends in manufacturing—has improved on a year-over-year basis.

But six out of 10 signs have yet to turn favorable for a market rebound, according to Bank of America.

The Federal Reserve must start cutting interest rates, which would signal that inflation is under control (in fact, the Fed has been increasing rates). Also the equity risk premium, or excess returns over the risk-free rate that investors expect for taking on the incremental risks connected to the market, must increase by more than 75 basis points.

Additionally, the two-year Treasury yield must decline 50 basis points or more from its highs; the yield curve—a tool that helps understand the bond market—must steepen; the trailing price-to-earnings ratio of the S&P 500 when added to the Consumer Price Index must be below 20; and there must be the presence of “Buy” signals within the Bank of America’s “Sell Side Indicator” that tracks average stock allocation recommendations by strategists.

In Bank of America’s view, the market has more room to drop. And it’s unclear when all of the signals of a rebound will switch from red to green.

This story was originally featured on Fortune.com

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Stock Market News – My Blog https://ift.tt/AUvGnqc

via IFTTT

No comments:

Post a Comment