Stocks tumbled Wednesday after Federal Reserve Chair Jerome Powell said inflation was still too high and indicated that the central bank has more rate hiking ahead.

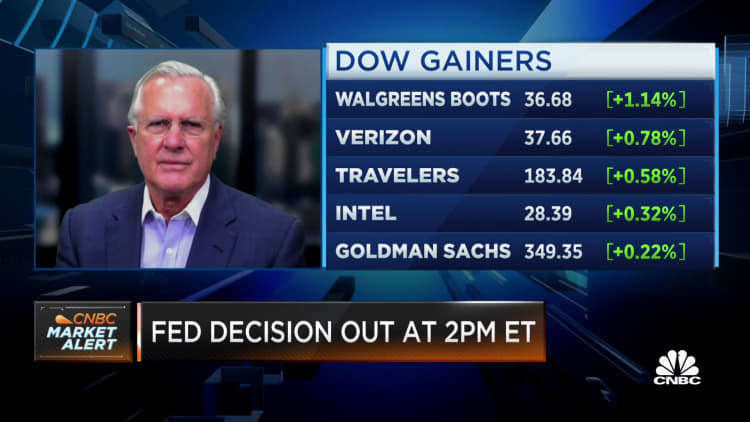

The Dow Jones Industrial Average slid 505.44 points, or 1.55%, to settle at 32,147.76. The S&P 500 dropped 2.5% to close at 3,759.69, while the Nasdaq Composite dove 3.36% to finish at 10,524.80.

The Fed implemented another 0.75 percentage point rate increase Wednesday afternoon and Powell said in a press conference that its inflation fight was far from done.

“We still have some ways to go and incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected,” he said.

Powell added that it was “premature” to talk about pausing hikes.

“We have a ways to go,” said the central bank chair.

Stocks initially rallied following the rate hike when the Fed’s accompanying statement hinted at a possible policy change in the future. “In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments,” the statement read.

Loading chart…

But traders’ hopes were dashed by Powell’s still tough talk on inflation.

“The tone of Fed Chair Jay Powell’s comments was quite hawkish, which means the Fed still has a way to go to fight inflation, and the level of interest rates will be higher than previously expected,” said Jack McIntyre, portfolio manager at Brandywine Global. “There were no hints of dovishness to indicate the Fed may be poised to pause.”

Consumer discretionary and information technology stocks were among the worst performers of the day. Both S&P 500 sectors shed more than 3%. Amazon, Netflix and Meta Platforms tumbled nearly 5% each. Tesla and Salesforce fell 5.6% and 6.1%, respectively.

The Fed’s rate decision came after the release of strong jobs data, with better-than-expected private payrolls data for October painting a resilient labor market. The JOLTS report Tuesday also conveyed a tight jobs market despite the Fed’s aggressive tightening clip.

The Dow is coming off a record October, rallying nearly 14% for its best month since 1976. The S&P and Nasdaq had gained about 8% and 3.9%, respectively, to snap a two-month losing streak. With Wednesday’s losses, the 30-stock index is down more than 11.5%, while the S&P and Nasdaq are off by 21.12% and 32.73%, respectively, year to date.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Wall Street Exchange – My Blog https://ift.tt/C8IvzKF

via IFTTT

No comments:

Post a Comment